Adoption of the Town’s 2021 budget and three-year investment plan

Sutton Town Council unanimously adopted its 2021 budget of $12,020,928 at the extraordinary meeting of 16 December 2020. The budget includes a freeze of all basic property tax rates and an adjustment of $9.90 for residential organic waste and recycling collections.

To access all information regarding 2021 budget:

- To watch the video recording of Special Council Meeting of December 16, 2020.

- To consult the presentation document on 2021 budget and 2021-2022-2023 Three-year Investment Plan.

- To see 2021 summary budget, 2021 detailed budget (in French) and 2021 tax rates.

The Majority of Taxes Frozen

One of the council’s key goals in preparing the 2021 budget was to minimize any increase in the tax burden for all types of property owners. This goal has been largely achieved. The basic property tax rates for all categories as well as the special tax for the public works reserve have both been frozen. Exceptionally, the tax for repayments of the general long-term debt has also been frozen. Furthermore, there will be no increase in residential tariffs for municipal water, sewers, or garbage collection nor for the emptying of septic systems.

Two categories were not frozen. The first is the cost for residential recycling and organic matter collections which will increase by a total of $9.90 per household—mainly due to new external service contracts. The second category relates to the increase (interest + capital) in the tax for the repayment of the long-term sector debt for work on the aerated ponds. This sum is charged only to properties served by the municipal sewer network. There is no fair way for the municipality to use its general funds to freeze a tax for services that benefit only a part of the population.

In sum, for an average house valued at $322,560 $ with neither municipal water nor sewers, the only increase for 2021 will be $9.90. For a house of the same value, with these services, located in the village core, the increase will be $41; this includes the $9.90 and the previously mentioned increase in the long-term debt sector tax.

Income and Expenses

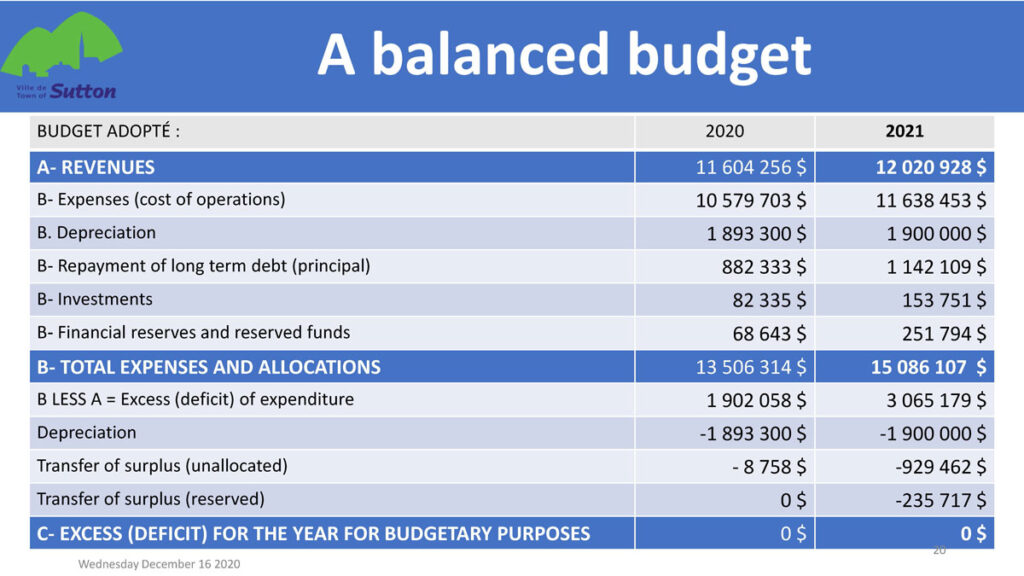

Revenues are estimated at $12,020,928 $, a growth of $417,672 $, or 3.6%. Forecast increases include growth of $120,000 for duties on transfers of immovables (welcome tax). However, new construction adds only $59,000 to property tax income.

Regarding expenses, a high proportion of costs remain subject to pressures beyond the direct control of the municipality. These include inflation (forecast at 1.6% for Quebec), an increase of 3.6% in the cost of the Town’s share of the bill for the Sûreté du Québec and the cost of external contracts. Some one-off events planned in 2021 will also have a financial impact for the Town, notably the municipal elections and the revision of the urban plan. In addition, the Town will increase its spending in important areas deemed to affect most of the population, such as road maintenance and the recruitment of a full-time communications officer. All this combined with the context of the pandemic and related ongoing expenses, results in an operating budget of $11,638,453 $ for 2021.

A Balanced Budget

Given the council’s desire to minimize increases to the financial burden on citizens and businesses, achieving a balanced budget for 2021 was a difficult challenge, This balance has been achieved thanks to several elements: first, the much higher level of existing reserves; second, the high probability that the year 2020 will end with an operating surplus of more than a million dollars, largely due to what may be a record level of welcome tax revenue; thirdly, continuous monitoring and careful control of spending; finally, the financial assistance of $361,217 given to the municipality by the provincial government in the context of the COVID-19 pandemic.

The Town will balance its budget in 2021 based on prudent management of its reserves, all the while making sure to keep them at a healthy level throughout 2021. The Council has worked hard to build reserves to their current levels in the interest of all citizens, not only for next year, but for future years.

Necessary Investments

Regarding investments, most of those planned for 2020 have been undertaken, such as replacing the major culvert on chemin Réal, or else the funding put in place, such as for the repaving of rue Mountain, between Billings and Schweizer so it can start early in 2021. The new three-year investment plan for 2021, 2022 and 2023 foresees a total of $12.3M in investments of which $3.2M is already confirmed or highly probable grant money. The focus remains on the renewal of critical water and sewer infrastructure, roads, and the renewal of municipal buildings, notably the John Sleeth community and cultural centre.

Major projects in 2021 include water, sewer and road work on rue Western, between rue Principale and chemin de la Vallée, paving and drainage work on chemin Scenic and the necessary replacement of the fire safety service pump truck. Other projects planned for 2021 include the addition and modernization of drinking fountains in public parks and a new petanque court. The council also hopes to establish a participatory budget process in 2021 to enable citizens to propose and vote for an investment project in one of the municipal parks.